WHY

cross ocean ventures

As Cross Ocean Venture general partners, we have all started companies, failed, and succeeded in building organizations with life-changing exits multiple times. We have immigrated from across the oceans to build enterprises. We have achieved this despite being part of underrepresented demographic groups.

We are founders and operators not bankers or consultants. We know that in the early days, founders need to have freedom, encouragement, exploration,and the ability to test and pivot fast.

While we don’t have a crystal ball, we have converted our experience into a roadmap to help our portfolio companies achieve product-market fit and reach critical milestones sooner.

Our own experiences as founders help us better connect with and evaluate founders before funding and communicate with and support the founders after funding. When we give examples, we talk with first-hand experiences, not textbooks or second-hand portfolio company experiences.

WHY

Why Founders Love Us?

Focused Investment Strategy

We focus our efforts on investment into early stage companies in the fields we have direct operator and founder experience such as B2B SaaS, digital health, digital identity and AI in key tech segments.

US Market Expansion Expertise

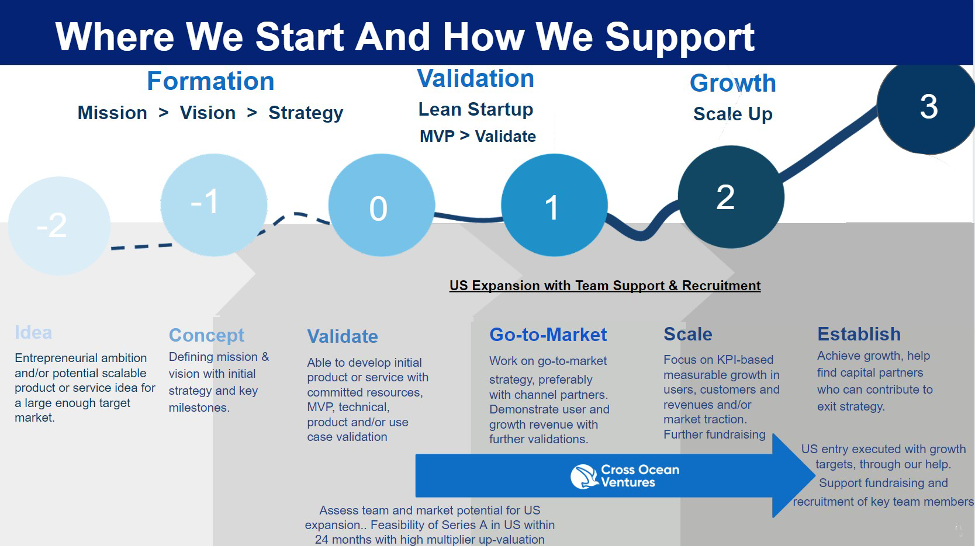

We invest in companies that are able to expand within the US Market. We

understand that whatever product market fit validations a company might have before

expanding in the US market might have to be revisited. Most likely there will be

product-market-refit and adjustment in go-to-market strategy for the US market.

Cross Ocean Fund team will help founders recruit key team members required for the US

ecosystem expansion, such as Chief Commercial Officer, Product Managers, Business

Development Executives. Cross Ocean Fund partners will be there to support at every step of

the process.

Founder Focused Mentorship

Even prior to investing, Cross Ocean Fund team members will provide

mentorship to help companies with their product-market-fit, marketing and sales channel

planning, business model development and fundraising strategy. This will be an

ongoing

service to all portfolio companies. This service will also be made available temporarily to

some prospective portfolio companies in order to wait for right timing or as a due diligence

process.

We Accelerate Growth

We are able to connect our partners to our strategic network in the USA to help drive sales and growth

for our portfolio companies. Finding the right channel partners, and establishing incentives that are

aligned between parties is a critical support we bring to the table.

Portfolio companies will require key service provider relationships that might include regulative

consulting, legal or financial services, commercialization or market research support.

All final decision making regarding these relationships will be done by the founders of the portfolio

companies.

Future Fundraising Support

Portfolio companies will require further seed funding in the US after the

initial phase. Cross Ocean Fund will take an active role in helping these portfolio

companies raise funding from US Angel Groups or seed stage VCs. Cross Ocean Fund

would make

introductions to different funding sources and guide the portfolio companies in their

dealings with the future investors.

asked questions

Frequently Asked Questions

What stage does Cross Ocean Fund invest in?

- We invest in seed, pre-seed, and a very select few idea stage companies if founders had successful exits before. Our ideal investment stage is determined by traction, founding team experience and inflection points in the horizon.

- We could be the first or one of the first institutional investors, but very rarely we would be among the first angel investors.

What is Cross Ocean Fund’s typical investment size?

For pre-seed investments, our typical first check size is up to $200,000. For seed investments, our typical investment size is up to $500,000. In addition, we will do follow-on investments (up to $1.5mil) to portfolio companies .

Which industries and verticals Cross Ocean Fund focuses?

The initial industry verticals Cross Ocean Ventures targets are determined in the intersection of the following considerations:

-

Target the new transformative technology companies in the high growth markets with no immediate clear market leaders and frequent/deep pain points for the customers. We see these areas as:

- Digital Health (that includes diagnostics, data, AI, mental health, substance abuse, employee wellness, wearable devices, VR/AR, telemedicine, neuroscience, healthcare delivery)

- Digital Identity (that includes data security, data integration, edtech, background screening, data verification, trusted data ecosystems, KYC, smart home, manufacturing security, employee management)

- B2B SaaS (that includes business intelligence, low/no-code, customer engagement, ecommerce, IoT, marketplaces, future of work, adtech, smart manufacturing, productivity, blockchain, predictive analytics)

-

Target the verticals where there are clear active potential acquirers with track records. Particularly the following sub segments:

- Digital Health: US Healthcare Networks, Telehealth Companies, Employee Wellness Companies, Wellness Platforms, Retail Pharmacy Providers, Healthcare Distribution, Top Healthcare Technology Providers, Substance Abuse and Addiction Service Providers, Digital Diagnostics Providers, Laboratory Service Providers, Wearable Device Companies, Health Clinics and Pharma

- Digital Identity: Financial Institutions, Top companies in the fields of Insurtech or Legaltech or Edtech, or Fintech, Background check companies, Payment platforms, Top IP Consulting and Advisory firms, Blockchain Platform Companies, Employee Management Platform and Solution Providers

- B2B SaaS: Healthcare platform enablers, Cloud storage providers, Cloud ERP providers, Ecommerce platform providers and marketplaces, Adtech platform providers, banking system platform providers, on-demand marketplaces, legacy mobility companies, IoT platform enablers and providers and large manufacturers for vertical industry applications

-

Target the verticals that we have significant advantages with operator experience among general partners, strategic and commercialization advisors. We have proven track record in operator experiences among digital health, digital identity and B2B SaaS applications

However, we keep our minds open to new ideas and we invest in founders who imagine changing the world with unique solutions to deep and growing pain points.

What if we already raised funding from Angel Investors or Institutional Investors, will Cross Ocean Fund be still interested in us?

We are completely comfortable partnering with other great angels and institutional investors.

What is Cross Ocean Fund’s investment decision-making process?

One of our general partners or analysts might reach out to you proactively to ask for a pitch deck. Or you submit your pitch deck directly to us, or we will get them via one of our deal-sharing partners.

One of our general partners will then schedule a Zoom call with the founder team (typically 30-45min). In this meeting, we get an overview of your company, the milestones you have reached, your fundraising, and short-term plans, ideally a real-time product demo.

After this meeting, if we believe there is a potential partnership opportunity, we will set up another follow-on meeting for a longer discussion where other general partners, fund advisors, and analysts might participate.

In this second meeting (typically 45min – 1:30 minutes) we will dive deeper into the product, solution, origin story, strategic plans, and competitive analysis and meet with the founder team.

Usually, after this meeting, we will be able to decide if we are interested to proceed with the due diligence process with you or wait for a lead investor to provide you with a term sheet.

What is Cross Ocean Fund’s investment decision-making process?

Provide a quick expansion framework to the US ecosystem:

Cross Ocean Ventures provide support in terms of strategic advice and facilitating/recruiting an interim chief commercialization officer in the US to help with product-market-fit adjustment and developing a robust go-to-market strategy. This interim chief commercial officer will be a former founder (or a former executive in a VC-backed company) with experience in the subject matter and often an investor/mentor. The same individual could also take an active part in follow-on funding rounds as a part of the leading team and often fill the gaps in the founders’ team background.

Provide additional funding support:

As active participants in Southern California, Silicon Valley, New York, and European startup ecosystems, we collaborate, deal-share, and co-invest with many investment companies.

We are very connected to various early-stage investors and Venture Capitalists. These connections include:

- VC firms in which Cross Ocean Ventures General Partners invest as Limited Partners.

- VCs with which we co-invest and share deals.

- VCs with which we serve alongside members in the same Angel Investor Networks.

- VCs with which we mentor in the same accelerator programs.

- We also encourage including qualified angel investors groups especially in the bridge funding rounds before the Series A.

Provide support to prepare for future Series A round:

High-quality venture capital firms that lead Series A funding rounds in the US have high expectations from European & Israeli startups. These investors do not like noise in business models and financials, expect established corporate governance and data rooms and would like to see specific plans of entity restructuring and cap table adjustments for a successful round. As Cross Ocean Ventures, we see this support as one of our most critical value adds. After all, without a successful Series A round and the proper growth partners, it is tough to scale up an organization to the following main inflection point.

Why is Cross Ocean Ventures’ team the right team to find, invest and support the next generation unicorns from Europe to expand to the US market?

Ethan Arsht, a data scientist with a degree in Near Eastern Studies, used the baseball Moneyball metrics to determine the ability of different generals to win battles and come up with a weighted WAR score. The result shows that the more battles a general has under their belt the better chance they have to win the next one as the general.

In summary, the more real battles a general sees in the trenches, the better general they become.

What does that mean in the world of entrepreneurship?

It is about seeing the everyday company building from the ground up, experiencing the first hiring to first firing, how to create a corporate culture, and influencing others to work as a team towards building the vision in the founders’ minds.

It is about knowing the difficulty of making payroll and understanding the value of bootstrapping before fund-raising to build a company.

It is about learning to be resourceful, creative, observant, proactive, and persistent to see through the inevitable hard days of building a company.

It is about experiencing the challenges of building corporate governance and finding and building a transparent, trusting relationship with your investors.

And it is about starting with the end in mind and building a business that will be worth more than the sum of its parts, creating and sharing the value with all the stakeholders.

Just like the generals that learn war in schools or the shadows of others in military war rooms will not be able to lead by example or understand what goes on on the battlegrounds, venture capitalists that do not build companies from the ground up will not understand what it takes to find, evaluate and support founders.

As Cross Ocean Venture general partners, we have all started companies, failed, and succeeded in building organizations with life-changing exits multiple times. We have immigrated from across the oceans to build enterprises. We have achieved this despite being part of underrepresented demographic groups.

Our battle experiences help us better connect with and evaluate founders before funding and communicate with and support the founders after funding. When we give examples, we talk with first-hand experiences, not textbooks or second-hand portfolio company experiences.